TL; DR Key Highlights

This white paper examines how recent global and local volatility in material and fuel prices has created significant risk for the Malaysian construction sector. It presents a comprehensive case for adopting a strategic, data-driven approach to project management by integrating drone mapping with BIM and CAD software. The analysis demonstrates how this technology provides a powerful solution to mitigate financial risk, reduce delays, and deliver tangible returns on investment for large-scale projects.

Executive Summary

The Malaysian construction industry has contended with significant material price volatility from 2020 to 2025, a period marked by global supply chain disruptions and local economic pressures. This unpredictability, more so than simple price inflation, has been a major driver of cost overruns and project delays, posing a systemic risk to large-scale infrastructure and building projects. This report argues that a potent solution lies in the strategic integration of drone-based data with Building Information Modeling (BIM) and Computer-Aided Design (CAD) software.

The analysis provides a compelling business case for technology adoption, substantiated by quantifiable returns on investment (ROI) and critical non-measurable benefits. Evidence from a major Malaysian infrastructure project demonstrates tangible cost savings of MYR 160 million from the implementation of a BIM-based Digital Twin. Furthermore, broader industry data reveals that this technology can reduce survey time by up to 70% and cut project costs by over 50%. Beyond the financial metrics, the report highlights strategic advantages such as enhanced worker safety, improved stakeholder collaboration, and the long-term sustainability of digital assets.

Looking ahead, while government initiatives such as the Construction 4.0 Strategic Plan and the National 4IR Policy provide a clear mandate for digital transformation, the industry still faces challenges related to a skills gap and an initial reluctance to adopt new technologies. The conclusion presents actionable recommendations for construction companies to navigate these hurdles, positioning them to gain a significant competitive advantage and contribute to Malaysia's national productivity goals.

1. The Problem: Material Price Volatility and its Impact on Malaysian Construction

The period from 2020 to 2025 presented a complex and challenging environment for the Malaysian construction sector, characterized by a series of interconnected global and local events that fueled unprecedented price fluctuations for key building materials. The COVID-19 pandemic initiated a cascade of disruptions, including global lockdowns that severed supply chains, leading to a scarcity of essential materials and widespread labor shortages. As the global economy began its recovery, a sharp increase in demand for raw materials converged with these lingering supply constraints, creating a perfect storm of inflationary pressure. This was further compounded by local factors, such as a significant increase in diesel prices, which surged by nearly 30% and directly impacted the cost of transporting heavy materials across the country.

1.1. Analysis of Key Material Price Trends (Steel, Cement, and Aggregates)

An examination of material price indices from the Department of Statistics Malaysia (DOSM) reveals a volatile and often paradoxical market. Price movements were not uniform; instead, they demonstrated a mixed trend with distinct regional variations and material-specific behaviors.

Steel: The unit price index for steel showed a multifaceted pattern. While some regions experienced significant annual declines, falling between 4.9% and 12.9% in most areas on an annual basis in July 2025, other regions saw a modest rise, such as Perak with a 1.2% increase and Terengganu and Kelantan with a 0.3% rise month-on-month. For the period from June to July 2025, the average price per metric tonne of steel actually rose by 0.2%.

Cement & Sand: In contrast to steel, cement prices remained largely stable nationwide in July 2025, though they recorded annual gains of between 0.1% and 3.7% in some states. Sand prices in Peninsular Malaysia remained steady, with only a marginal 0.1% rise in the Selangor, W.P. Kuala Lumpur, Melaka, and Negeri Sembilan region. However, increases were more pronounced in Sabah and Sarawak, ranging from 0.1% to 0.5%.

This data reveals that the primary challenge was not uniform price escalation but the profound unpredictability of the market. The paradox of a mixed trend—where some materials or regions see prices fall while others see them rise—introduces immense complexity for project budgeting and procurement. This constant fluctuation complicates inventory valuation and exposes large-scale projects to significant financial risk, as a contractors cost estimates can become obsolete in a matter of weeks, potentially leading to incorrect planning and scheduling.

1.2. Consequence Analysis: The Financial and Operational Toll of Price Volatility

The financial and operational consequences of this price volatility have been severe. Research indicates that financial issues are a big headache for the Malaysian construction industry, with material price fluctuations being a common factor causing cost overruns. This unpredictability has been found to be a root cause of incorrect planning and scheduling by contractors, which in turn cascades into poor site management. The ultimate outcome of this chain of events is often project delays, postponements, or even termination, with a slight delay having the potential to be very costly for all stakeholders.

This situation highlights a systemic project risk that extends beyond simple financial loss. It reveals how the unpredictability of material costs can disrupt the entire project management lifecycle. The issue is not merely that prices are high, but that their volatility undermines fundamental project controls, such as budgeting, procurement, and scheduling. This instability makes it difficult for companies to maintain a competitive edge and complete projects on time and within budget, ultimately threatening the industry's long-term sustainability.

1.3. Global Geopolitical Dynamics and Their Local Echoes

While local factors and the post-pandemic recovery have played a significant role in price volatility, a number of recent global geopolitical events have added layers of complexity and risk. The Malaysian construction industry, which relies heavily on imported supplies, is highly sensitive to these disruptions.

The Russia-Ukraine Conflict: The invasion of Ukraine has had a significant impact on global supply chains, exacerbating an already strained market for raw materials, particularly steel. This conflict has contributed to a global surge in steel prices, with experts warning that if the situation persists, it could lead to material shortages that would stall construction activities. The conflict has also driven up prices for energy and food, contributing to broader inflation in Malaysia.

Conflicts in the Middle East: While the direct economic impact of the Israel-Gaza conflict on Malaysia's construction sector is not publicly documented, the broader instability in the Middle East has had a local impact. The conflict has brought Gaza's economy to a near-total collapse, with a staggering 86% contraction in the first quarter of 2024 and an almost 250% increase in the price of basic commodities. More critically for Malaysia, ongoing tensions and conflicts in the region, such as the June 2025 Israeli strikes on Iran and Iran's retaliatory actions, can create risks to the Strait of Hormuz. As a critical chokepoint for global oil, any disruption there could cause a rapid escalation in crude oil and petroleum product prices. Given that heavy construction machinery and transportation in Malaysia run on diesel, this instability poses a direct risk to project costs.

The US-China Tariff War: The ongoing trade conflict between the United States and China, with planned escalations and additional tariffs, creates significant market uncertainty and has a complex, dual effect on Malaysia. While the tariffs can lead to suppressed global prices for basic metals like scrap and rebar, they also cause a redirection of supply chains. In the short term, Malaysia has seen some benefits from this trade diversion, with record exports to the US and a surge in Foreign Direct Investment (FDI) as companies adopt a China+1 strategy. However, this trade disruption still affects Malaysia's trade balance and can create new logistical challenges.

2. The Solution: A Digital Twin for Mitigating Price Volatility

In the face of such systemic risk, the Malaysian construction industry can find a powerful solution in the strategic integration of drone-based data with BIM and CAD software. This technological approach transforms a static project plan into a dynamic, data-rich digital twin, providing a robust framework to manage and mitigate the risks posed by material price volatility.

2.1. The Technological Framework: From Drone Data to a Digital Twin

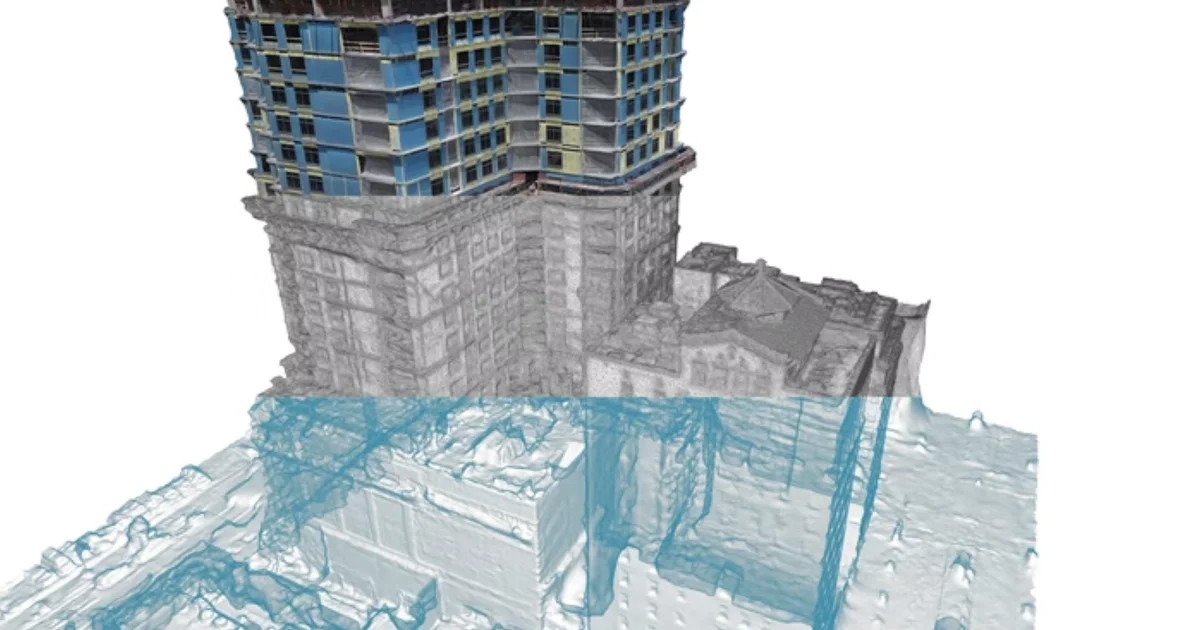

The foundation of this solution is a well-defined Scan-to-BIM workflow. This process begins with data acquisition and culminates in the creation of a comprehensive digital model of the construction site.

Data Acquisition: Drones equipped with high-resolution cameras and LiDAR sensors are used to survey a job site. This aerial approach is significantly faster and more efficient than traditional, manual methods. For example, a single drone can scan a 100-acre site in less than an hour, a task that would take ground-based teams days or even weeks.

Data Processing: The raw data collected by the drone is processed to generate a high-precision point cloud. A point cloud is a digital representation of a physical space, composed of millions of data points, each with a unique set of geographic coordinates. This raw data is then cleaned and filtered to remove noise or irrelevant points, ensuring the highest level of accuracy for subsequent modeling.

Digital Modeling and Integration: The processed point cloud is imported into BIM software, such as Autodesk Revit, or CAD software like AutoCAD. Using the point cloud as a precise digital blueprint, project teams create a 3D BIM model, building elements such as walls, floors, and pipes. This process creates a living as-built digital twin that serves as a single, authoritative source of data for the entire project lifecycle.

2.2. The Logical Chain of Reasoning: Connecting Technology to Risk Reduction

The integration of this digital workflow directly addresses the core challenges posed by material price volatility through a clear chain of causal links.

Real-time Volumetric & Inventory Management: Drones provide an unmatched ability to perform rapid volumetric measurements of material stockpiles on-site. This data is processed to calculate precise volumes of cut, fill, sand, gravel, and other aggregates. This capability is a direct countermeasure to the risk of financial loss due to over-purchasing and material waste. By providing a real-time, accurate inventory count, companies can optimize material orders, reducing the need for costly over-purchasing and limiting their financial exposure to sudden price increases.

Progress Monitoring & Quality Assurance: Regular drone fly-overs can be programmed to follow consistent flight paths, capturing high-resolution data at specified intervals. This as-built data is then overlaid onto the as-designed BIM model. This overlay allows for immediate and accurate clash detection, identifying design errors or misalignments between different building elements before they can become costly problems on-site. This proactive approach helps avoid expensive rework and minimizes the likelihood of project delays that stem from incorrect planning and poor site management.

Enhanced Site Logistics & Supply Chain Visibility: The dynamic digital twin can be used for advanced 4D construction site logistics, which adds the dimension of time to the 3D model. This provides a comprehensive and continuously updated aerial view of the site, allowing for better resource allocation and optimized movement of heavy machinery. This is particularly critical in managing the supply chain, as it provides real-time visibility into the location and utilization of materials, helping to streamline operations and ensure efficient delivery and consumption of materials.

3. Quantitative and Strategic Benefits

The investment in drone-BIM integration is not merely a strategic decision; it is a financially prudent one, supported by compelling quantitative data and real-world case studies. The savings and efficiency gains are substantial and can significantly offset the initial costs of technology adoption.

3.1. Quantifiable Benefits of Technology Adoption

Industry analysis provides a clear picture of the financial returns:

The evidence is clear, the technology provides impressive returns across various phases of a project. For instance, the Minnesota Department of Transportation has reported a 40% cost saving on bridge inspections using drones, with the average cost per inspection dropping from $40,800 to just $19,900. In a broader context, an American Society of Civil Engineers (ASCE) study revealed an impressive ROI of up to 980% for drone-based infrastructure management, positioning the technology as a highly promising and cost-effective tool.

3.2. Case Study: The Pan Borneo Highway's Digital Twin Success

The most compelling argument for the technology's effectiveness comes from a major Malaysian infrastructure project itself. The Pan Borneo Highway, a massive MYR 16.15 billion initiative, served as a pioneering case study in the strategic integration of BIM, GIS, and drone technology. The project leveraged a Highway Information Model (HIM), which combined BIM and Geographical Information Systems (GIS) with LiDAR data collected via drones to create a Digital Twin of the project site.

This digital replica enabled teams to work collaboratively on a connected data environment (CDE), allowing for seamless information sharing and coordination on the cloud. The result was a documented savings of MYR 160 million in Phase-I of the project. While a granular breakdown of this figure is not available, the savings can be attributed to several key areas identified through general research on BIM-drone integration:

This case study demonstrates that the benefits are not theoretical but are being realized on a large scale in Malaysia, setting a new benchmark for future projects. It is a powerful example of how a data-driven approach can translate directly into substantial financial returns.

3.3. Non-Measurable Benefits: The Strategic Value Proposition

Beyond the impressive financial gains, the integration of drone and BIM technology offers a suite of strategic, non-quantifiable benefits that enhance a company's long-term value and competitive position. These advantages, while not easily measured on a balance sheet, are critical to a modern, sustainable business.

Enhanced Worker Safety: The use of drones fundamentally improves worker safety by eliminating the need for human personnel to enter hazardous or difficult-to-reach areas of a construction site. This reduces the risk of accidents, which in turn leads to lower liability and insurance costs for the contractor.

Improved Communication and Transparency: Drone data provides a singular, trustworthy, and consistent perspective of a project at any given time. This visual information can be shared instantly with all stakeholders, from on-site teams to off-site managers and investors. This seamless information exchange reduces miscommunication and conflicting data, which are common causes of project errors and delays.

Long-Term Asset Management and Sustainability: The Digital Twin created during the design and construction phases serves as a valuable asset for long-term facilities management, post-construction operations, and future renovations. The models can be used to monitor the building's performance and identify potential issues through predictive maintenance.

4. The Path Forward: Challenges, Trends, and Recommendations

The future of the Malaysian construction industry is intrinsically linked to its ability to embrace digital transformation. The period from 2025 to 2030 is poised to be one of significant growth, but also one that will demand a departure from traditional, low-tech practices.

4.1. The Malaysian Construction Landscape: Drivers for Digital Transformation

The Malaysian government has established a clear mandate for the industry's digital evolution. The Construction 4.0 Strategic Plan (2021-2025), spearheaded by the Construction Industry Development Board (CIDB), aims to position Malaysia as a leader in Southeast Asian construction through the integration of emerging technologies. This plan is in alignment with the broader National 4IR Policy, which sets an ambitious target of a 30% productivity increase across all sectors by 2030.

The market outlook for this period is robust. The construction industry is expected to grow at a compound annual growth rate (CAGR) of 5.83% from 2024 to 2030, driven by significant public infrastructure projects like the MRT3, Pan Borneo Highway, and new data center developments. Private investments in residential and mixed-use developments, particularly in urban centers like Kuala Lumpur and Johor Bahru, will also contribute to this growth. This combination of strong government support and a positive market forecast creates a compelling environment for the adoption of innovative technologies.

4.2. Persistent Challenges and Strategic Recommendations

Despite the clear benefits and government support, the Malaysian construction industry faces persistent challenges that threaten to slow the pace of digital transformation. While awareness of BIM is high (74% awareness in 2019), the rate of adoption has lagged behind developed nations, with only a 55% adoption rate in 2021. This reveals a critical disconnect between policy and practice.

The primary barriers to technology adoption are not technical but human and financial. Research indicates that the industry is still in its infancy when it comes to drone adoption, facing challenges such as a lack of knowledge, a skills gap, high initial costs, and a general reticence to adopt new technologies. This is exacerbated by the fact that the industry is fragmented, and there is a lack of publicly shared information and case studies on the monetary benefits of technology use. For example, studies into the adoption of technology in leading construction companies such as Sunway Construction and SP Setia reveal an awareness and willingness to innovate, but a scarcity of publicly available project-specific data to inspire broader industry confidence.

This suggests that a government policy push is not enough. The industry must overcome these cultural and financial hurdles from within. The first companies to successfully navigate these challenges and transparently demonstrate their financial and strategic gains will not only gain a significant competitive edge but will also serve as vital models for the rest of the industry, accelerating the pace of transformation.

To move from a state of awareness to widespread adoption, senior decision-makers in the Malaysian construction sector should consider the following strategic recommendations:

Invest in a Phased Technology Adoption Plan: Rather than a large, immediate investment, companies should begin with a small-scale, high-impact pilot project. A focus on a single application, such as volumetric stockpile management, can provide an immediate and measurable return, building internal confidence and expertise for future, broader implementation.

Prioritize Workforce Upskilling: Acknowledge and proactively address the skills gap by investing in comprehensive training programs for drone operation and BIM software. Partnering with professional training providers or drone service companies can bridge this gap and cultivate a tech-savvy workforce that is comfortable with modern workflows.

Leverage Government Support: Align with national initiatives such as the Construction 4.0 Strategic Plan and the National 4IR Policy to access potential government incentives, funding, or collaborative platforms aimed at accelerating digital transformation.

Establish a Collaborative Ecosystem: Encourage the sharing of best practices and project case studies within the industry. By documenting and publicizing the quantifiable and non-measurable benefits, companies can help to reduce the collective reticence to adopt and establish new industry benchmarks, benefiting the entire ecosystem.

Choose the Right Technology Partner: Select a drone and software services provider that offers certified pilots, a proven workflow, and seamless integration with existing BIM or CAD platforms. This partnership will ensure high-quality data collection and processing, enabling project teams to focus on using the insights to make better, faster decisions.

Partner with Malaysia's Leading Drone Technology Specialists

Dronify delivers the comprehensive drone-BIM integration capabilities that Malaysian construction companies need to navigate material price volatility and achieve measurable cost savings.

Our proven approach includes:

- Regulatory Compliance: Full CAAM certification ensuring legal operation and professional standards

- Technical Expertise: ±2cm accuracy RTK/GPS systems delivering survey-grade data suitable for BIM integration

- Construction Experience: Proven track record with enterprise clients including Gamuda Group, Ranhill Group, and MADA

- Comprehensive Deliverables: Point clouds, 3D models, and volumetric analysis compatible with BIM/CAD software

Ready to implement digital twin technology for your construction projects?

📱 WhatsApp: [+6014 338 7131](https://wa.me/60143387131?text=Hi, I'm interested in drone-BIM integration for construction cost management) 📧 Email: enquiry@dronify.my 📞 Phone: +6014 338 7131

Experience the difference that survey-grade accuracy and professional expertise make in construction cost management and digital transformation.